What Was The First Country To Print Paper Money

A banknote—also called a pecker (North American English language), paper money, or only a note—is a blazon of negotiable promissory note, made by a bank or other licensed potency, payable to the bearer on demand. Banknotes were originally issued past commercial banks, which were legally required to redeem the notes for legal tender (normally gold or silver coin) when presented to the chief cashier of the originating banking company. These commercial banknotes only traded at face up value in the market served by the issuing bank.[1] Commercial banknotes have primarily been replaced by national banknotes issued past primal banks or monetary authorities.

National banknotes are often – merely not always – legal tender, meaning that courts of law are required to recognize them equally satisfactory payment of money debts.[2] Historically, banks sought to ensure that they could always pay customers in coins when they presented banknotes for payment. This practice of "backing" notes with something of substance is the basis for the history of fundamental banks bankroll their currencies in gilt or silvery. Today, about national currencies have no backing in precious metals or commodities and have value only by fiat. With the exception of non-circulating loftier-value or precious metal issues, coins are used for lower valued monetary units, while banknotes are used for college values.

Code of Hammurabi Law 100 (c. 1755–1750 BC) stipulated repayment of a loan by a debtor to a creditor on a schedule with a maturity engagement specified in written contractual terms.[3] [4] [5] Law 122 stipulated that a depositor of golden, silver, or other chattel/movable property for safekeeping must nowadays all manufactures and a signed contract of bailment to a notary before depositing the articles with a banker, and Police force 123 stipulated that a banker was discharged of whatever liability from a contract of bailment if the notary denied the existence of the contract. Law 124 stipulated that a depositor with a notarized contract of bailment was entitled to redeem the entire value of their deposit, and Law 125 stipulated that a banker was liable for replacement of deposits stolen while in their possession.[6] [seven] [5]

In China during the Han dynasty, promissory notes appeared in 118 BC and were made of leather.[eight] Rome may have used a durable lightweight substance as promissory notes in 57 AD which have been found in London.[9] All the same, Carthage was purported to have issued depository financial institution notes on parchment or leather before 146 BC. Hence Carthage may be the oldest user of lightweight promissory notes.[ten] [11] [12] The starting time known banknote was showtime adult in China during the Tang and Song dynasties, starting in the seventh century. Its roots were in merchant receipts of eolith during the Tang dynasty (618–907), equally merchants and wholesalers desired to avert the heavy bulk of copper coinage in large commercial transactions.[13] [14] [15] During the Yuan dynasty (1271–1368), banknotes were adopted by the Mongol Empire. In Europe, the concept of banknotes was first introduced during the 13th century by travelers such equally Marco Polo,[16] [17] with European banknotes appearing in 1661 in Sweden.

Counterfeiting, the forgery of banknotes, is an inherent challenge in issuing currency. It is countered by anticounterfeiting measures in the printing of banknotes. Fighting the counterfeiting of banknotes and cheques has been a principal driver of security printing methods evolution in recent centuries.

History [edit]

Paper currency first developed in Tang dynasty China during the 7th century, although true paper money did non appear until the 11th century, during the Vocal dynasty. The use of paper currency later spread throughout the Mongol Empire or Yuan dynasty Mainland china. European explorers like Marco Polo introduced the concept in Europe during the 13th century.[sixteen] [17] Napoleon issued paper banknotes in the early 1800s.[18] Greenbacks paper coin originated as receipts for value held on business relationship "value received", and should not be conflated with promissory "sight bills" which were issued with a promise to convert at a later date.

The perception of banknotes as money has evolved over time. Originally, money was based on precious metals. Banknotes were seen by some as an I.O.U. or promissory annotation: a promise to pay someone in precious metal on presentation (see representative money). Merely they were readily accepted - for convenience and security - in London, for example, from the late 1600s onwards. With the removal of precious metals from the budgetary system, banknotes evolved into pure fiat coin.

Early Chinese paper coin [edit]

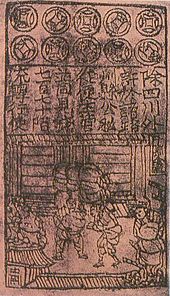

Song Dynasty Jiaozi, the globe's earliest paper money.

A Yuan dynasty printing plate and banknote with Chinese words.

The showtime banknote-blazon musical instrument was used in China in the 7th century, during the Tang dynasty (618–907). Merchants would issue what are today called promissory notes in the grade of receipts of eolith to wholesalers to avoid using the heavy majority of copper coinage in big commercial transactions.[xix] [xiv] [15] Before the use of these notes, the Chinese used coins that were circular, with a rectangular hole in the middle. Coins could be strung together on a rope. Merchants, if they were rich enough, found that the strings were too heavy to carry effectually hands, especially for large transactions. To solve this problem, coins could be left with a trusted person, with the merchant beingness given a sideslip of newspaper (the receipt) recording how much money they had deposited with that person. When they returned with the newspaper to that person, their coins would be returned.

True paper coin, called "jiaozi", developed from these promissory notes past the 11th century, during the Song dynasty.[twenty] [21] By 960, the Song government was brusk of copper for hit coins, and issued the starting time generally circulating notes. These notes were a promise by the ruler to redeem them afterwards for some other object of value, ordinarily specie. The issue of credit notes was often for a limited duration, and at some discount to the promised amount later. The jiaozi did not replace coins but was used aslope them.

The central government soon observed the economic advantages of printing paper coin, issuing a monopoly for the issue of these certificates of deposit to several eolith shops.[nineteen] By the early twelfth century, the amount of banknotes issued in a single year amounted to an annual charge per unit of 26 million strings of cash coins.[15] By the 1120s the cardinal authorities started to produce its own state-issued newspaper money (using woodblock printing).[19]

Fifty-fifty before this point, the Song government was amassing large amounts of newspaper tribute. It was recorded that each year earlier 1101, the prefecture of Xin'an (modern Shexian, Anhui) lonely would send ane,500,000 sheets of newspaper in seven different varieties to the capital at Kaifeng.[22] In 1101, the Emperor Huizong of Song decided to lessen the amount of paper taken in the tribute quota, because it was causing detrimental effects and creating heavy burdens on the people of the region.[23] Nevertheless, the government nevertheless needed masses of paper product for the commutation certificates and the state'south new issuing of paper money. For the printing of paper money alone, the Vocal government established several regime-run factories in the cities of Huizhou,[ which? ] Chengdu, Hangzhou, and Anqi.[23]

The workforce employed in these paper money factories was quite large; it was recorded in 1175 that the factory at Hangzhou alone employed more than a chiliad workers a day.[23] Nonetheless, the regime problems of newspaper money were not yet nationwide standards of currency at that point; bug of banknotes were limited to regional areas of the empire, and were valid for use but in a designated and temporary limit of 3 years.[15]

The geographic limitation changed between 1265 and 1274, when the late southern Song government issued a nationwide paper currency standard, which was backed by gold or argent.[15] The range of varying values for these banknotes was perchance from ane cord of cash to ane hundred at the virtually.[xv] Always after 1107, the authorities printed coin in no less than six ink colors and printed notes with intricate designs and sometimes even with mixture of a unique fiber in the newspaper to combat counterfeiting.

The founder of the Yuan dynasty, Kublai Khan, issued paper coin known as Jiaochao. The original notes were restricted by surface area and duration, as in the Vocal dynasty, but in the later years, facing massive shortages of specie to fund their dominion, the paper money began to be issued without restrictions on duration. Venetian merchants were impressed by the fact that the Chinese paper money was guaranteed by the Country.

European explorers and merchants [edit]

According to a travelogue of a visit to Prague in 960 by Ibrahim ibn Yaqub, small pieces of cloth were used as a ways of trade, with these cloths having a set exchange rate versus silvery.[24]

Around 1150, the Knights Templar would consequence notes to pilgrims. Pilgrims would deposit valuables with a local Templar preceptory before embarking for the Holy Land and receive a certificate indicating the value of their eolith. They would then use that document upon arrival in the Holy Land to receive funds from the treasury of equal value.[25] [26]

In the 13th century, Chinese newspaper money of Mongol Yuan became known in Europe through the accounts of travelers, such as Marco Polo and William of Rubruck.[16] [27] Marco Polo'south account of newspaper money during the Yuan dynasty is the subject of a chapter of his book, The Travels of Marco Polo, titled "How the Great Kaan Causeth the Bawl of Trees, Made into Something Like Newspaper, to Pass for Money All Over his Land."[17]

All these pieces of paper are, issued with as much solemnity and authority as if they were of pure gold or silver... with these pieces of paper, made as I accept described, Kublai Khan causes all payments on his ain account to be made; and he makes them to pass current universally over all his kingdoms and provinces and territories, and whithersoever his power and sovereignty extends... and indeed everybody takes them readily, for wheresoever a person may go throughout the Nifty Kaan's dominions he shall find these pieces of paper current, and shall exist able to transact all sales and purchases of goods by means of them just as well equally if they were coins of pure gold

In medieval Italy and Flanders, considering of the insecurity and impracticality of transporting large sums of cash over long distances, coin traders started using promissory notes. In the beginning these were personally registered, simply they soon became a written gild to pay the amount to whoever had it in their possession. These notes are seen as a predecessor to regular banknotes by some but are mainly thought of as proto bills of exchange and cheques.[28] The term "bank annotation" comes from the notes of the bank ("nota di banco") and dates from the 14th century; information technology originally recognized the right of the holder of the notation to collect the precious metal (usually gold or silver) deposited with a broker (via a currency account). In the 14th century, it was used in every part of Europe and in Italian urban center-state merchants colonies outside of Europe. For international payments, the more efficient and sophisticated bill of commutation ("lettera di cambio"), that is, a promissory note based on a virtual currency account (usually a coin no longer physically existing), was used more ofttimes. All concrete currencies were physically related to this virtual currency; this instrument besides served as credit.

Nascence of European banknotes [edit]

The shift toward the use of these receipts as a ways of payment took place in the mid-17th century, as the cost revolution, when relatively rapid gold inflation was causing a re-assessment of how money worked. The goldsmith bankers of London began to give out the receipts as payable to the bearer of the document rather than the original depositor. This meant that the note could be used every bit currency based on the security of the goldsmith, not the account holder of the goldsmith-banker.[30] The bankers also began issuing a greater value of notes than the total value of their physical reserves in the course of loans, on the assumption that they would non take to redeem all of their issued banknotes at the same fourth dimension. This pivotal shift inverse the simple promissory note into an agency for the expansion of the monetary supply itself. As these receipts were increasingly used in the coin circulation system, depositors began to inquire for multiple receipts to be made out in smaller, stock-still denominations for utilize as coin. The receipts before long became a written order to pay the amount to whoever had possession of the note. These notes are credited every bit the kickoff modern banknotes.[28] [31]

The get-go short-lived attempt at issuing banknotes by a central bank was in 1661 by Stockholms Banco, a predecessor of Sweden's central bank Sveriges Riksbank.[32] These replaced the copper-plates being used instead as a means of payment.[33] This banknote issue was brought about past the peculiar circumstances of the Swedish coin supply. Inexpensive foreign imports of copper had forced the Crown to steadily increase the size of the copper coinage to maintain its value relative to argent. The heavy weight of the new coins encouraged merchants to deposit information technology in exchange for receipts. These became banknotes when the manager of the Bank decoupled the rate of note event from the banking concern currency reserves. Three years after, the bank went broke, later rapidly increasing the bogus money supply through the big-scale printing of paper money. A new banking company, the Riksens Ständers Bank was established in 1668, simply did not issue banknotes until the 19th century.[34]

Permanent consequence of banknotes [edit]

The sealing of the Banking company of England Lease (1694). The Banking company began the get-go permanent effect of banknotes a year later.

The modern banknote rests on the assumption that money is adamant by a social and legal consensus. A gold money'south value is simply a reflection of the supply and need machinery of a society exchanging appurtenances in a free market place, equally opposed to stemming from whatsoever intrinsic property of the metallic. By the late 17th century, this new conceptual outlook helped to stimulate the issue of banknotes. The economist Nicholas Barbon wrote that money "was an imaginary value made by a law for the convenience of substitution."[35]

A temporary experiment of banknote result was carried out by Sir William Phips as the Governor of the Province of Massachusetts Bay in 1690 to aid fund the war effort against France.[36] The other Xiii Colonies followed in Massachusetts' wake and began issuing bills of credit, an early form of newspaper currency distinct from banknotes, to fund war machine expenditures and for use as a mutual medium of exchange.[37] By the 1760s, these bills of credit were used in the majority of transactions in the 13 Colonies.[38]

The first banking company to initiate the permanent outcome of banknotes was the Bank of England. Established in 1694 to raise money for the funding of the state of war against France, the bank began issuing notes in 1695 with the hope to pay the bearer the value of the note on demand. They were initially handwritten to a precise amount and issued on deposit or as a loan. At that place was a gradual move toward the issuance of fixed denomination notes, and past 1745, standardized printed notes ranging from £20 to £ane,000 were being printed. Fully printed notes that did not crave the name of the payee and the cashier'due south signature get-go appeared in 1855.[39]

The Scottish economist John Law helped plant banknotes every bit a formal currency in French republic, after the wars waged by Louis XIV left the country with a shortage of precious metals for coinage.

In the United states in that location were early attempts at establishing a central bank in 1791 and 1816, but it was only in 1862 that the federal regime of the United States began to print banknotes.

Primal bank issuance of legal tender [edit]

Originally, the banknote was simply a promise to the bearer that they could redeem it for its value in specie, just in 1833 the 2nd in a series of Banking concern Charter Acts established that banknotes would be considered equally legal tender during peacetime.[40]

Until the mid-nineteenth century, commercial banks were able to effect their ain banknotes, and notes issued past provincial banking companies were the common grade of currency throughout England, outside London.[41] The Bank Lease Act of 1844, which established the modern cardinal bank,[42] restricted authorisation to issue new banknotes to the Bank of England, which would henceforth accept sole command of the money supply in 1921. At the aforementioned fourth dimension, the Bank of England was restricted to issue new banknotes but if they were 100% backed by gold or up to £14 one thousand thousand in government debt. The Act gave the Bank of England an effective monopoly over the note outcome from 1928.[43] [44]

Issue of banknotes [edit]

Collage for banknote design with annotations and additions to show proposed changes (effigy rather higher so equally to allow room for the No.), Bank of Manchester, UK, 1833. On display at the British Museum in London

More often than not, a central banking concern or treasury is solely responsible within a state or currency union for the effect of banknotes. However, this is not always the example, and historically the paper currency of countries was frequently handled entirely past private banks. Thus, many different banks or institutions may take issued banknotes in a given state. Commercial banks in the United States had legally issued banknotes before there was a national currency; however, these became bailiwick to government authorization from 1863 to 1932. In the last of these serial, the issuing bank would postage stamp its name and promise to pay, along with the signatures of its president and cashier on a preprinted annotation. By this time, the notes were standardized in appearance and non too different from Federal Reserve Notes.

A$5 notation issued past Citizens Bank of Louisiana in the 1850s.

In a modest number of countries, private banknote outcome continues to this twenty-four hours. For instance, by virtue of the circuitous constitutional setup in the United Kingdom, sure commercial banks in ii of the state's four constituent countries (Scotland and Northern Republic of ireland) go on to print their own banknotes for domestic apportionment, even though they are not fiat coin or alleged in law as legal tender anywhere. The UK'south key bank, the Bank of England, prints notes which are legal tender in England and Wales; these notes are also usable as coin (but not legal tender) in the remainder of the UK (see Banknotes of the pound sterling).

In the two Special Administrative Regions of the People'south Republic of Mainland china, arrangements are similar to those in the UK; in Hong Kong, three commercial banks are licensed to upshot Hong Kong dollar notes,[45] and in Macau, banknotes of the Macanese pataca are issued past two unlike commercial banks. In Grand duchy of luxembourg, the Banque Internationale à Grand duchy of luxembourg was entitled to outcome its own Luxembourgish franc notes until the introduction of the Euro in 1999.[46]

As well equally commercial issuers, other organizations may accept note-issuing powers; for example, until 2002 the Singapore dollar was issued past the Board of Commissioners of Currency Singapore, a regime agency which was later taken over past the Monetary Authority of Singapore.[45]

Equally with whatsoever press, there is also a chance for banknotes to have printing errors. For U.S. banknotes, these errors can include board break errors, butterfly fold errors, cut errors, dual denomination errors, fold over errors, and misalignment errors.[47]

Advantages and disadvantages [edit]

When Brazil changed currencies in 1989, the 1000, 5000, and x,000 cruzados banknotes were overstamped and issued as 1, v, and 10 cruzados novos banknotes for several months before cruzado novo banknotes were printed and issued. Banknotes tin can be overstamped with new denominations, typically when a country converts to a new currency at an even, fixed substitution rate (in this instance, 1000:1).

Prior to the introduction of banknotes, precious or semiprecious metals minted into coins to certify their substance were widely used as a medium of commutation. The value that people attributed to coins was originally based upon the value of the metal unless they were token issues or had been debased. Banknotes were originally a claim for the coins held by the bank, but due to the ease with which they could be transferred and the confidence that people had in the capacity of the bank to settle the notes in coin if presented, they became a popular means of exchange in their ain correct. They now brand upwardly a very modest proportion of the "coin" that people call back that they accept equally demand deposit banking company accounts and electronic payments accept negated the demand to carry notes and coins.

Banknotes have a natural advantage over coins in that they are lighter to carry, but they are also less durable than coins. Banknotes issued by commercial banks had counterparty risk, meaning that the bank may not be able to make payment when the note was presented. Notes issued by central banks had a theoretical risk when they were backed by gold and silver. Both banknotes and coins are subject to inflation. The durability of coins means that even if metal coins melt in a fire or are submerged under the sea for hundreds of years they still have some value when they are recovered. Gilded coins salvaged from shipwrecks retain almost all of their original appearance, but silverish coins slowly corrode.[48] [49]

Other costs of using bearer money include:

- Discounting to face up value: Earlier national currencies and efficient clearing houses, banknotes were only redeemable at face value at the issuing banking company. Even a branch bank could discount notes of other branches of the aforementioned bank. The discounts unremarkably increased with distance from the issuing bank. The disbelieve also depended on the perceived safety of the banking concern. When banks failed, the notes were usually partly redeemed out of reserves, merely sometimes became worthless.[50] [51] The problem of discounting inside a country does not exist with national currencies; however, under floating commutation rates currencies are valued relative to i another in the foreign exchange market.

- Counterfeiting paper notes has always been a problem, peculiarly since the introduction of color photocopiers and reckoner image scanners. Numerous banks and nations have incorporated many types of countermeasures in lodge to keep the money secure. However, extremely sophisticated counterfeit notes known every bit superdollars have been detected in contempo years.

- Manufacturing or outcome costs. Coins are produced by industrial manufacturing methods that process the precious or semi-precious metals, and require additions of alloy for hardness and clothing resistance. By contrast, bank notes are printed paper (or polymer), and typically have a higher cost of outcome, especially in larger denominations, compared with coins of the same value.

- Clothing costs. Banknotes don't lose economic value by wear, since, even if they are in poor status, they are still a legally valid claim on the issuing bank. However, banks of issue exercise accept to pay the cost of replacing banknotes in poor condition, and paper notes wear out much faster than coins.

- Cost of transport. Coins can be expensive to transport for high value transactions, but banknotes can be issued in large denominations that are lighter than the equivalent value in coins.

- Cost of acceptance. Coins tin be checked for actuality by weighing and other forms of examination and testing. These costs tin can be significant, but good quality coin design and manufacturing can help reduce these costs. Banknotes too have an acceptance cost – the expense of checking the banknote'due south security features and confirming acceptability of the issuing bank.

The different advantages and disadvantages of coins and banknotes imply that there may be an ongoing part for both forms of bearer money, each being used where its advantages outweigh its disadvantages.

Materials used for banknotes [edit]

Paper banknotes [edit]

Obverse and contrary of an old American $100 note (1928)

Well-nigh banknotes are fabricated from cotton fiber newspaper with a weight of 80 to xc grams per square meter. The cotton is sometimes mixed with linen, abaca, or other material fibres. More often than not, the paper used is different from ordinary paper: information technology is much more than resilient, resists article of clothing and tear (the average life of a banknote is two years),[52] and also does not contain the usual agents that make ordinary paper glow slightly under ultraviolet light. Unlike most press and writing paper, banknote newspaper is infused with polyvinyl alcohol or gelatin, instead of water, to give it actress strength. Early on Chinese banknotes were printed on paper made of mulberry bark. Mitsumata (Edgeworthia chrysantha) and other fibers are used in Japanese banknote paper[53] (a kind of Washi).

Nearly banknotes are made using the mould made process in which a watermark and thread is incorporated during the paper forming process. The thread is a elementary looking security component establish in nearly banknotes. It is however often rather circuitous in construction comprising fluorescent, magnetic, metallic and micro impress elements. By combining it with watermarking technology the thread can be made to surface periodically on one side only. This is known as windowed thread and further increases the apocryphal resistance of the banknote paper. This process was invented by Portals, part of the De La Rue group in the UK. Other related methods include watermarking to reduce the number of corner folds by strengthening this part of the note. Varnishing and coatings reduce the accumulation of dirt on the note for longer durability in circulation.

Another security feature is based on windows in the paper which are covered by holographic foils to make information technology very hard to copy. Such technology is applied equally a portrait window for the college denominations of the Europa serial (ES2) of the euro banknotes.[54] Windows are also used with the Hybrid substrate from Giesecke+Devrient which is composed of an inner layer of paper substrate with thin outer layers of plastic moving-picture show for high durability.[55]

History of counterfeiting and security measures [edit]

When paper bank notes were first introduced in England, they resulted in a dramatic ascension in counterfeiting.[ citation needed ] The attempts by the Bank of England and the Royal Mint to stamp out currency law-breaking led to new policing strategies, including the increased use of entrapment.[56]

The characteristics of banknotes, their materials and production techniques (every bit well as their evolution over history) are topics that commonly aren't thoroughly examined past historians, even though now at that place are a number of works detailing how banking concern notes were actually synthetic. This is mostly due to the fact that historians prioritize the theoretical understanding of how coin worked rather than how information technology was produced.[57] The first great deterrent against counterfeiting was the death sentence for forgers, merely this wasn't enough to stop the ascent of counterfeiting. Over the eighteenth century, far fewer banknotes were circulating in England compared to the smash of bank notes in the nineteenth century; because of this, improving note-making techniques wasn't considered a compelling event.

In the eighteenth century, banknotes were produced mainly through copper-plate engraving and printing and they were single-sided. Notes making technologies remained basically the same during the eighteenth century[58] The first banknotes were produced through the and so-called intaglio press, a technique that consisted of engraving a copper plate by hand then covering it in ink to print the depository financial institution notes. Only with this technique information technology was possible, at that time, to forcefulness the paper into the lines of the engraving and to make suitable banknotes. Another factor that fabricated it harder to counterfeit banknotes was the paper, since the blazon of paper used for banknotes was rather different from the newspaper commercially available at that time. Despite this, some forgers managed to successfully forge notes past getting involved with and consulting paper makers, in order to make a similar kind of paper by themselves.[59] Furthermore, watermarked paper was likewise used since banknotes first appeared; it involved the sewing of a thin wire frame into paper mould. Watermarks for notes were first used in 1697 by a Berkshire paper maker whose proper noun was Rice Watkins.[59] Watermarks, together with a special paper blazon, were supposed to make it harder and more expensive to forge banknotes, since more complex and expensive paper making machines were needed in society to make them.

At the kickoff of the nineteenth century (the so-chosen Bank Brake Period, 1797-1821), the dramatically increased demand of bank notes slowly forced the banks to refine the technologies employed.[59] In 1801, watermarks, which previously were direct lines, became wavy, thanks to the thought of a watermark mould maker whose proper noun was William Brewer. This fabricated even harder the counterfeiting of banking company notes, at to the lowest degree in the short term, since in 1803 the number of forged bank notes brutal to but 3000, compared to 5000 of the previous year[60] In the aforementioned menstruum, depository financial institution notes likewise started to become double-sided and with more complex patterns, and banks asked skilled engravers and artists to help them make their notes harder to counterfeit (episode labelled by historians as "the search for the inimitable banknote").[61]

The ease with which paper coin can be created, by both legitimate authorities and counterfeiters, has led both to a temptation in times of crunch such as war or revolution to produce paper money which was not supported past precious metallic or other appurtenances, thus leading to Hyperinflation and a loss of faith in the value of paper money, east.1000. the Continental Currency produced by the Continental Congress during the American Revolution, the Assignats produced during the French Revolution, the paper currency produced past the Confederate States of America and the individual states of the Confederate States of America, the financing of Globe War I by the Fundamental Powers (by 1922 1 gold Austro-Hungarian krone of 1914 was worth 14,400 paper Kronen), the devaluation of the Yugoslav Dinar in the 1990s, etc. Banknotes may also be overprinted to reverberate political changes that occur faster than new currency tin be printed.

In 1988, Republic of austria produced the 5000 Schilling banknote (Mozart), which is the start foil application (Kinegram) to a paper banknote in the history of banknote printing. The application of optical features is now in mutual utilise throughout the globe. Many countries' banknotes now accept embedded holograms.

Polymer banknotes [edit]

In 1983, Costa Rica and Haiti issued the first Tyvek and the Island of Human issued the get-go Bradvek polymer (or plastic) banknotes; these were printed by the American Banknote Company and developed by DuPont. These early plastic notes were plagued with issues such every bit ink wearing off and were discontinued. In 1988, after significant enquiry and development in Australia by the Republic Scientific and Industrial Inquiry Arrangement (CSIRO) and the Reserve Bank of Commonwealth of australia, Australia produced the first polymer banknote made from biaxially-oriented polypropylene (plastic), and in 1996, it became the first country to have a full set of circulating polymer banknotes of all denominations completely replacing its paper banknotes. Since and so, other countries to adopt circulating polymer banknotes include Bangladesh, Brazil, Brunei, Canada, Chile, Guatemala, Dominican Republic, Indonesia, Israel, Malaysia, Mexico, Nepal, New Zealand, Papua New Guinea, Paraguay, Romania, Samoa, Singapore, the Solomon Islands, Thailand, Trinidad and Tobago, the United Kingdom, Uruguay, Vietnam, and Zambia, with other countries issuing commemorative polymer notes, including China, State of kuwait, the Northern Bank of Northern Ireland, Taiwan and Hong Kong.[62] Another land indicating plans to event polymer banknotes is Nigeria.[ commendation needed ] In 2005, Bulgaria issued the globe's first hybrid paper-polymer banknote.[ citation needed ]

Polymer banknotes were developed to meliorate durability and foreclose counterfeiting through incorporated security features, such as optically variable devices that are extremely difficult to reproduce.

Other materials [edit]

Over the years, a number of materials other than paper have been used to print banknotes. This includes various textiles, including silk, and materials such every bit leather.[64]

Silk and other fibers take been commonly used in the industry of various banknote papers, intended to provide both boosted durability and security. Crane and Company patented banknote paper with embedded silk threads in 1844 and has supplied newspaper to the United States Treasury since 1879. Banknotes printed on pure silk "paper" include "emergency money" Notgeld issues from a number of German towns in 1923 during a menstruum of financial crisis and hyperinflation. Most notoriously, Bielefeld produced a number of silk, leather, velvet, linen and forest problems. These issues were produced primarily for collectors, rather than for apportionment. They are in demand by collectors. Banknotes printed on cloth include a number of Communist Revolutionary issues in Cathay from areas such as Xinjiang, or Sinkiang, in the United Islamic Commonwealth of East Turkestan in 1933. Emergency coin was also printed in 1902 on khaki shirt material during the Boer War.

Cotton fibers together with 25% linen is the textile of the banknotes in the United states of america. Leather banknotes (or coins) were issued in a number of sieges, as well every bit in other times of emergency. During the Russian administration of Alaska, banknotes were printed on sealskin. A number of 19th century issues are known in Germanic and Estonia, including the places of Dorpat, Pernau, Reval, Werro and Woiseck. In addition to the Bielefeld issues, other German leather Notgeld from 1923 is known from Borna, Osterwieck, Paderborn and Pößneck.

Other issues from 1923 were printed on wood, which was too used in Canada in 1763–1764 during Pontiac'southward Rebellion, and by the Hudson's Bay Company. In 1848, in Bohemia, wooden checkerboard pieces were used as money.

Fifty-fifty playing cards were used for currency in France in the early 19th century, and in French Canada from 1685 until 1757, the Colony of Louisiana, Dutch Guiana, and in the Isle of mann in the first of the 19th century, and once again in Germany after World War I.

Most recently, Bisphenol S (BPS), has been oftentimes used in the production of banknotes worldwide. BPS is an endocrine disruptor that is subject to human dermal absorption through handling banknotes.[65]

Vertical orientation [edit]

The Colombian 50,000 peso notation, presented in a vertical format.

Vertical currency is a type of currency in which the orientation has been changed from the conventional horizontal orientation to a vertical orientation. Dowling Duncan, a cocky-touted multidisciplinary design studio, conducted a study in which they determined people tend to handle and deal with money vertically rather than horizontally, especially when the currency is processed through ATM and other coin machines. They as well notation how money transactions are conducted vertically non horizontally.[66] Bermuda, Cape verde, System of Eastern Caribbean States, Israel, Switzerland, and Venezuela take adopted vertically oriented currency, although Israel and Republic of cape verde have now reverted to horizontal orientation.[67]

Since 1979, Sri Lanka has printed the contrary of its banknotes vertically. Betwixt 1993 and 2013, Brazil has printed banknotes of 5000 and 50000 cruzeiros reais and the starting time Brazilian existent series of banknotes has the obverse in traditional horizontal layout, while the reverse is in vertical format. The 2018 Hong Kong dollar banknotes series too has the obverse in traditional horizontal layout, while the contrary is in vertical format.[68]

Early Chinese banknotes were also vertical, due to the direction of Chinese writing.

The 2018 Canadian $10 nib featuring a portrait of Canadian civil rights pioneer Viola Desmond is presented in a vertical format.[69] [seventy] The Northern Irish £v and £ten notes issued by Ulster Banking company for 2019 will also be presented in this way.[71]

Vending machines and banknotes [edit]

In the late 20th century, vending machines were designed to recognize banknotes of the smaller values long after they were designed to recognize coins distinct from slugs.[ where? ] This capability has get inescapable in economies where inflation has not been followed by introduction of progressively larger coin denominations (such as the United States, where several attempts to make dollar coins popular in general circulation accept largely failed). The existing infrastructure of such machines presents one of the difficulties in irresolute the blueprint of these banknotes to make them less counterfeitable, that is, by adding additional features then easily discernible by people that they would immediately decline banknotes of inferior quality, for every automobile in the land would have to be updated.[ citation needed ]

Devastation [edit]

A 5 euro note so badly damaged it has been torn in half. The annotation has later been repaired with record.

A banknote is removed from circulation because of everyday vesture and tear from its handling. Banknotes are passed through a banknote sorting machine for determining actuality and fitness for apportionment, or may be classified unfit for circulation if they are worn, dirty, soiled, damaged, mutilated or torn. Unfit notes are returned to the fundamental bank for secure online devastation by high-speed banknote sorting machines using a cross-cutting shredder device similar to a paper shredder with security level P-5 (pieces smaller than thirty mm²) according to the standard DIN 66399–2. This small size decomposes a banknote into typically more than than 500 tiny pieces and rules out reconstruction like a jigsaw puzzle considering the shreds from many banknotes are commingled.

A subsequent briquettor compresses shredded newspaper material into a small-scale cylindrical or rectangular form for the disposal (e. grand. landfill or burning[72]) Before the 1990s, unfit banknotes were destroyed past incineration with a higher risk of manipulations.

When a Federal Reserve Banking company of the U.s. receives a cash deposit from a commercial bank or another financial institution, it checks the private notes to determine whether they are fit for future circulation.[73] Nearly ane-3rd of the notes that the Fed receives are unfit, and the Fed destroys them. US dollar banknotes last an average of more than five years.[74]

Contaminated banknotes are also decommissioned and removed from circulation, primarily to prevent the spread of diseases. A Canadian government report indicates:

Types of contaminants include: notes found on a corpse, brackish water, contaminated by human or beast torso fluids such as urine, carrion, vomit, infectious blood, fine chancy powders from detonated explosives, dye pack and/or drugs...[75]

In the US, the nickname "Fed Shreds" refers to paper coin which has been shredded afterwards becoming unfit for apportionment. Although these shredded banknotes are mostly landfilled, they are sometimes sold or given away in small-scale numberless as souvenirs or as briquettes.[76]

Polymer banknotes may be shredded and then melted downwardly and recycled to grade plastic products like edifice components, plumbing fittings, or compost bins.[77]

- Shredded Banknotes

-

-

Shreds of unfit US dollar notes with a typical size of less than ane.5 mm x 16 mm

Intelligent banknote neutralisation systems [edit]

Intelligent banknote neutralisation systems (IBNS) are security systems which render banknotes unusable by marker them permanently equally stolen with a degradation agent. Marked (stained) banknotes cannot exist brought back into circulation hands and can be linked to the criminal offense scene. Today's most used degradation agent is a special security ink which cannot exist removed from the banknote easily and non without destroying the banknote itself, but other agents too exist. Today IBNSs are used to protect banknotes in automated teller machines, retail machines, and during cash-in-transit operations.

Dynamic Intelligent Currency Encryption [edit]

Dynamic Intelligent Currency Encryption (Die) is a security engineering introduced in 2014 past British company EDAQS, which devaluates banknotes remotely that are illegal or have been stolen. The engineering is based on identifiable banknotes - that could be an RFID chip or a barcode - and connects to a digital security organization to verify the validity of the banknote. The company claims that the banknotes are unforgeable and contribute to solve cash-related issues every bit well as fight offense and terrorism. In another annotation, the Die benefits encompass and solve almost all cash-related issues that are seen by governments to be a motivation for the progressive abolition of greenbacks.[78] [79]

Confiscation and asset forfeiture [edit]

In the United States in that location are many laws that allow the confiscation of cash and other avails from the bearer if there is suspicion that the money came from an illegal activity.[80] Because a significant amount of U.South. currency contains traces of cocaine and other illegal drugs, it is not uncommon for innocent people searched at airports or stopped for traffic violations to have cash in their possession sniffed past dogs for drugs and and so accept the cash seized considering the domestic dog smelled drugs on the money. It is then upwardly to the owner of the coin to evidence where the cash came from at his own expense. Many people merely forfeit the money.[81] In 1994, the U.s. Court of Appeals, Ninth Excursion, held in the case of United states of America v. U.S. CURRENCY, $thirty,060.00 (39 F.3d 1039 63 USLW 2351, No. 92-55919) that the widespread presence of illegal substances on paper currency in the Los Angeles expanse created a situation where the reaction of a drug-sniffing domestic dog would not create probable crusade for civil forfeiture.[82]

Paper money collecting every bit a hobby [edit]

Banknote collecting, or notaphily, is a slowly growing area of numismatics. Although more often than not not as widespread every bit coin and stamp collecting, the hobby is slowly expanding. Prior to the 1990s, currency collecting was a relatively pocket-size adjunct to coin collecting, but currency auctions and greater public awareness of paper money have caused more interest in rare banknotes and consequently their increased value.[ citation needed ] The most valuable banknote is the $chiliad beak issued in 1890 that was sold at an sale for $2,255,000.

Trades [edit]

For years, the mode of collecting banknotes was through a scattering of post society dealers who issued price lists and catalogs. In the early on 1990s, it became more common for rare notes to be sold at various coin and currency shows via auction. The illustrated catalogs and "event nature" of the sale practice seemed to fuel a precipitous rise in overall awareness of paper money in the numismatic community. The emergence of currency third political party grading services (similar to services that course and "slab", or encapsulate, coins) also may accept increased collector and investor interest in notes. Entire advanced collections are oftentimes sold at one time, and to this solar day single auctions can generate millions in gross sales. Today, eBay has surpassed auctions in terms of highest volume of sales of banknotes.[83] [84] [85] Notwithstanding, rare banknotes even so sell for much less than comparable rare coins. This disparity is diminishing as paper coin prices continue to rise. A few rare and historical banknotes accept sold for more than a million dollars.[86]

There are many dissimilar organizations and societies around the globe for the hobby, including the International Bank Note Society (IBNS), which currently assert to have effectually two,000 members in xc countries.[87]

Novelty [edit]

The universal entreatment and instant recognition of bank notes has resulted in a plethora of novelty merchandise that is designed to have the advent of newspaper currency. These items cover almost every class of product. Fabric textile printed with banking concern note patterns is used for clothing, bed linens, curtains, upholstery and more. Acrylic paperweights and even toilet seats with bank notes embedded within are as well common. Items that resemble stacks of bank notes and tin be used as a seat or ottoman are also bachelor.

Manufacturers of these items must take into consideration when creating these products whether the product could be construed as counterfeiting. Overlapping note images and/or changing the dimensions of the reproduction to exist at to the lowest degree fifty% smaller or 50% larger than the original are some means to avert the take a chance of beingness considered a apocryphal. Just in cases where realism is the goal, other steps may be necessary. For instance, in the stack of bank notes seat mentioned earlier, the decal used to create the product would be considered counterfeit. However, one time the decal has been affixed to the resin stack shell and cannot be peeled off, the terminal product is no longer at risk of being classified as apocryphal, even though the resulting appearance is realistic.

See also [edit]

- Banknote counter

- J. S. 1000. Boggs

- Contaminated currency

- Hell money

- Hybrid paper-polymer banknote

- Intaglio

- List of motifs on banknotes

- List of people on banknotes

- Money creation

- Postal currency

- Seigniorage

- Trevett five. Weeden

- The states Notation

- Used notation

Notes and references [edit]

- ^ Atack & Passell (1994), p. 469.

- ^ "Legal Tender Guidelines". British Royal Mint. Archived from the original on 17 Dec 2008. Retrieved 2 September 2007.

- ^ Hammurabi (1903). Translated past Sommer, Otto. "Code of Hammurabi, King of Babylon". Records of the Past. Washington, DC: Records of the Past Exploration Social club. two (3): 75. Retrieved xx June 2021.

100. Anyone borrowing money shall ... his contract [for payment].

- ^ Hammurabi (1904). "Code of Hammurabi, Male monarch of Babylon" (PDF). Freedom Fund. Translated by Harper, Robert Francis (second ed.). Chicago: University of Chicago Printing. p. 35. Retrieved xx June 2021.

§100. ...he shall write downwards ... returns to his merchant.

- ^ a b Hammurabi (1910). "Code of Hammurabi, King of Babylon". Avalon Project. Translated by King, Leonard William. New Oasis, CT: Yale Law School. Retrieved 20 June 2021.

- ^ Hammurabi (1903). Translated by Sommer, Otto. "Code of Hammurabi, Male monarch of Babylon". Records of the Past. Washington, DC: Records of the Past Exploration Society. ii (3): 77. Retrieved 20 June 2021.

122. If anyone entrusts to ... accept committed an offence.

- ^ Hammurabi (1904). "Lawmaking of Hammurabi, Male monarch of Babylon" (PDF). Liberty Fund. Translated by Harper, Robert Francis (second ed.). Chicago: University of Chicago Press. p. 43. Retrieved 20 June 2021.

§122. If a homo requite ... it from the thief.

- ^ "NOVA - The History of Money". pbs.org.

- ^ "Ancient Roman IOUs Institute Below Bloomberg's New London HQ". 1 June 2016. Retrieved 9 June 2018.

- ^ Jones, John Percival (1890). Speeches of J.P. Jones: Money and Tariff, 1890-93.

- ^ Moulton, Luther Vanhorn (1880). The Science of Money and American Finances. Co-operative Press. p. 134.

- ^ Wells, H. K. (1921). The outline of history, being a evidently history of life and mankind. New York: The Macmillan Company.

- ^ Ebrey, Walthall & Dominican Republic (2006), p. 156. sfnp fault: no target: CITEREFEbreyWalthallDominican_Republic2006 (aid)

- ^ a b Bowman (2000), p. 105.

- ^ a b c d due east f Gernet (1962), p. eighty.

- ^ a b c William N. Goetzmann; K. Geert Rouwenhorst (1 August 2005). The Origins of Value: The Financial Innovations that Created Modern Capital Markets. Oxford University Press. p. 94. ISBN978-0-xix-517571-four.

The Mongols adopted the Jin and Vocal practice of issuing paper money, and the primeval European account of paper money is the detailed description given by Marco Polo, who claimed to accept served at the court of the Yuan dynasty rulers.

- ^ a b c Marco Polo (1818). The Travels of Marco Polo, a Venetian, in the Thirteenth Century: Being a Description, past that Early on Traveller, of Remarkable Places and Things, in the Eastern Parts of the Earth. pp. 353–355. Retrieved 19 September 2012.

- ^ "Affiliate 12: Security Printing and Seals" (PDF). Security Applied science: A Guide to Edifice Dependable Distributed Systems. p. 245.

The introduction of paper coin into Europe by Napoleon in the early 1800s, and of other valuable documents such as bearer securities and passports, kicked off a battle between security printers and counterfeiters

- ^ a b c Ebrey, Walthall & Palais (2006), p. 156.

- ^ Peter Bernholz (2003). Monetary Regimes and Inflation: History, Economic and Political Relationships. Edward Elgar Publishing. p. 53. ISBN978-i-84376-155-vi.

- ^ Daniel R. Headrick (1 April 2009). Technology: A World History. Oxford University Printing. p. 85. ISBN978-0-19-988759-0.

- ^ Needham (1986), p. 47.

- ^ a b c Needham (1986), p. 48.

- ^ Jankowiak, Marek. Dirhams for slaves. Medieval Seminar, All Souls, 2012, p.8

- ^ Sarnowsky, Jürgen (2011). Templar Order. doi:10.1163/1877-5888_rpp_com_125078. ISBN978-9-0041-4666-2.

- ^ Martin, Sean (2004). The Knights Templar: The History and Myths of the Legendary Armed forces Gild (1st ed.). New York: Thunder's Mouth Press. ISBN978-1560256458. OCLC 57175151.

- ^ Moshenskyi, Sergii (2008). History of the weksel: Bill of exchange and promissory note. p. 55. ISBN978-1-4363-0694-two.

- ^ a b De Geschiedenis van het Geld (the History of Money), 1992, Teleac, page 96

- ^ "Sverige, Palmstruchska banken, Kreditsedel 10 daler silvermynt, 17 april 1666" [Europe'south kickoff banknotes]. Alvin (in Swedish).

- ^ Faure AP (half dozen Apr 2013). "Money Cosmos: Genesis 2: Goldsmith-Bankers and Bank Notes". Social Science Inquiry Network. SSRN 2244977.

- ^ Vincent Lannoye (2011). The History of Money for Agreement Economics. Vincent Lannoye. p. 132. ISBN978-ane-4802-0066-1.

- ^ Geisst, Charles R. (2005). Encyclopedia of American business history. New York. p. 39. ISBN978-0-8160-4350-vii.

- ^

- ^ "The showtime European banknote". Cité de 50'économie et de la monnaie.

- ^ Nicholas Barbon, Soapbox on Trade, 1690. p.37

- ^ Patrick Dillon (2007). The Terminal Revolution: 1688 and the Creation of the Modernistic World. Random Business firm. pp. 344–346. ISBN9781844134083.

- ^ Newman, Eric P. (1990). The Early on Newspaper Money of America (3rd ed.). Krause Publications. ISBN0-87341-120-X.

- ^ Bouton, Terry (2007). Taming Commonwealth: "The People," the Founders, and the Troubled Ending of the American Revolution. Oxford Academy Press. p. 17. ISBN978-0195378566.

- ^ "A brief history of banknotes". Bank of England. Archived from the original on 29 September 2013. Retrieved 17 Dec 2013.

- ^ "Currency and Depository financial institution Notes Deed, 1928" (PDF). world wide web.legislation.gov.uk . Retrieved 17 December 2012.

- ^ "£2 notation issued past Evans, Jones, Davies & Co". British Museum. Archived from the original on 18 January 2012. Retrieved 31 October 2011.

- ^ Capie, Forrest; Fischer, Stanley; Goodhart, Charles; Schnadt, Norbert (1994). "The development of central banking". The futurity of primal banking: the tercentenary symposium of the Bank of England . Cambridge, U.k.: Cambridge Academy Press. ISBN978-0-5214-9634-vi . Retrieved 17 December 2012 – via LSE Research Online.

- ^ Jeffrey A. Tucker (16 September 2010). "Yesterday was a Historic Day". Mises Wire. Mises Found. Archived from the original on eighteen September 2010. Retrieved 17 September 2010.

- ^ Horsefield, J. One thousand. (November 1944). "The Origins of the Depository financial institution Lease Act, 1844". Economica. New. 11 (44): 180–189. doi:10.2307/2549352. JSTOR 2549352.

- ^ a b Committee on Payment and Settlement Systems (August 2003). "The Role of Cardinal Bank Money in Payment Systems" (PDF). Bank for International Settlements. p. 96. Archived (PDF) from the original on 9 September 2008. Retrieved 14 August 2008.

Although historically not the case, these days banknotes are usually issued only by the central banking company. This is broadly the example in all CPSS economies, except Hong Kong SAR, where banknotes are issued by three commercial banks. Singapore and the United Kingdom are more limited exceptions. Singapore dollar banknotes have been issued past the Lath of Currency Commissioners, a government agency, although following the merger of the Board into the MAS in Oct 2002 this is no longer the example. In the United Kingdom, Scottish banks retain the right to issue banknotes alongside those of the Depository financial institution of England and three banks currently still do and so.

- ^ "BIL'due south history". Banque Internationale à Luxembourg. Retrieved xiii December 2013.

- ^ "Error Is Human: Role I - PMG". www.pmgnotes.com . Retrieved 16 April 2018.

- ^ Famous shipwrecks from which valuable precious metals and coins were recovered in recent years include the Atocha and the SS Central America. Shipwreck coins are highly collectible, and dealers post photos on the internet.

- ^ "Virtual Shipwreck and Hoard Map by Daniel Frank Sedwick, LLC". sedwickcoins.com.

- ^ Atack & Passell (1994), pp. 84–86.

- ^ Taylor, George Rogers (1951). The Transportation Revolution, 1815–1860. New York, Toronto: Rinehart & Co. ISBN978-0-87332-101-3.

- ^ "The Banknote Lifecycle – from Pattern to Destruction". De La Rue. Archived from the original on 13 May 2012.

- ^ "Banknote Product Process". world wide web.npb.go.jp. [Japanese] National Printing Bureau. Retrieved 16 Apr 2018.

- ^ "Security features. Europa series €100 banknote". European Key Bank. 2019. Retrieved 11 July 2019.

- ^ "Hybrid Banknote Substrate". Papierfabrik Louisenthal . Retrieved 11 July 2019.

- ^ Crymble, Adam (2018). "How Criminal were the Irish? Bias in the Detection of London Currency Crime, 1797-1821". The London Journal. 43 (1): 36–52. doi:10.1080/03058034.2016.1270876.

- ^ Mockford, 2014; pp. 118-119 quote="Detailed discussion of the textile characteristics of Banking concern Notes, also as the methods used in their structure, have therefore tended to constitute merely a footnote in historical works that have often prioritised both contemporary and modern theoretical understandings of coin and exchange."

- ^ Mockford, 2014; p. 121 quote="The technologies employed past the Bank in the making of its notes were ones that contradistinct very little throughout the course of the long eighteenth century, with major changes not occurring until well after the shut of this flow."

- ^ a b c Mockford, 2014; pp. 122-123

- ^ Mockford, 2014; pp. 126

- ^ Mockford, 2014; p. 127

- ^ "Our Currency". About Australia. Australian Government. Archived from the original on seven June 2011. Retrieved 19 July 2011.

- ^ Walter Grasser / Albert Option: Das Bielefelder Stoffgeld 1917 - 1923, Berlin 1972 (German)

- ^ S.K. Singh, Bank Regulation, Discovery Publishing Business firm, New Delhi, 2009, pp.26-27.

- ^ Liao C; Liu F; Kannan Thou (2012). "Bisphenol S, a New Bisphenol Counterpart, in Newspaper Products and Currency Bills and Its Association with Bisphenol A Residues". Environmental Scientific discipline & Engineering. 46 (12): 6515–6522. Bibcode:2012EnST...46.6515L. doi:10.1021/es300876n. PMID 22591511.

- ^ "Dowling Duncan redesign the United states of america banknotes". Dowling | Duncan. 14 Baronial 2010. Archived from the original on 23 April 2011. Retrieved 15 Baronial 2012.

- ^ "Israel'south New Banknotes". Bank of State of israel.

- ^ "2018 New Series Hong Kong Banknotes" (Press release). Hong Kong Monetary Authority. 24 July 2018. Retrieved 24 July 2018.

- ^ Brett Bundale (8 March 2018). "Canada unveils $10 bill featuring civil rights icon Viola Desmond". The Star. Toronto Star Newspapers. Retrieved 16 April 2018.

- ^ "New $10 bank note featuring Viola Desmond unveiled on International Women's Day" (Press release). Bank of Canada. 8 March 2018. Retrieved 16 April 2018.

- ^ "Ulster Bank reveals 'vertical' banknotes". The Irish News. 24 May 2018. Retrieved 25 May 2018.

- ^ Hungarians burn down shredded money to stay warm (Motion pic). Agence France-Presse. 2012. Archived from the original on ii November 2021. .

- ^ "Fitness Guidelines for Federal Reserve Notes" (PDF). Federal Reserve Organization Cash Product Office (CPO). vii Feb 2019. Retrieved ten July 2019.

- ^ "How Currency Gets into Circulation". Federal Reserve Bank of New York. 2013. Retrieved 9 July 2019.

- ^ Trichur, Rita (28 September 2007). "Bankers wipe out dirty money". Toronto Star. Archived from the original on xvi October 2007. Retrieved 28 September 2007.

- ^ "Currency Processing and Destruction". Federal Reserve Banking concern of New York. 2014. Retrieved 9 July 2019.

- ^ "Recycling". Reserve Bank of Australia . Retrieved ix July 2019.

- ^ "EDAQS Publishes the Die – The New Banknote Applied science That Protects Citizens and Fights Crime". digitaljournal.com.

- ^ "The Futurity of Banknotes & How One Company Is Working To Forbid A Cashless Economy". LinkedIn Pulse. eighteen May 2015.

- ^ "International Society for Private Freedom". Archived from the original on nine June 2012.

- ^ "Drug Dog's "Alert" to Cash Non Grounds for Forfeiture When Upward to 75 percent of Currency Tainted With Drugs". ndsn.org.

- ^ "Resource.org". Archived from the original on 3 June 2013. Retrieved 16 April 2018.

- ^ "You lot Won a Lottery, Got an Award, or a Mystery Shopper Chore and They Sent You a Check! Apocryphal Cashiers Checks". Consumer Fraud Report. Retrieved 27 Baronial 2011.

- ^ "Forged German Treasure Banknotes". mebanknotes. 28 May 2008. Retrieved 27 August 2011.

- ^ Cyndy Aleo-Carreira (25 March 2009). "2 Million Counterfeit Items Removed From EBay". PC Earth. Retrieved 27 August 2011.

- ^ Bank Note (23 August 2011). "Long Beach Auction Set up". World Record Academy. Retrieved 27 August 2011.

- ^ "Introducing the IBNS". IBNS. Retrieved 6 October 2012.

Bibliography [edit]

- Atack, Jeremy; Passell, Peter (1994). A New Economical View of American History. New York: Due west.W. Norton and Co. ISBN978-0-393-96315-1.

- Bowman, John S. (2000). Columbia Chronologies of Asian History and Civilisation . New York: Columbia University Press. ISBN978-0-2311-1004-4.

- Ebrey; Walthall; Palais (2006). East asia: A Cultural, Social, and Political History. Boston: Houghton Mifflin Company. ISBN978-0-6181-3384-0.

- Gernet, Jacques (1962). Daily Life in China on the Eve of the Mongol Invasion, 1250–1276. Stanford Academy Printing. ISBN978-0-8047-0720-6.

- Needham, Joseph (1986). Scientific discipline and Culture in China: Volume 5, Office 1. Cambridge Academy Press. ISBN978-0-5218-7566-0.

- Mockford, Jack (2014). "They are Exactly equally Banknotes are": Perceptions and Technologies of Banking concern Note Forgery During the Bank Restriction Period, 1797-1821 (PDF) (PhD). University of Hertfordshire.

External links [edit]

| | Wikimedia Commons has media related to Banknotes. |

- Counterfeit money was a major problem in the 1850s - Pantagraph (Bloomington, Illinois newspaper)

Source: https://en.wikipedia.org/wiki/Banknote

Posted by: brownfuleat.blogspot.com

0 Response to "What Was The First Country To Print Paper Money"

Post a Comment